1031 Exchange Worksheet

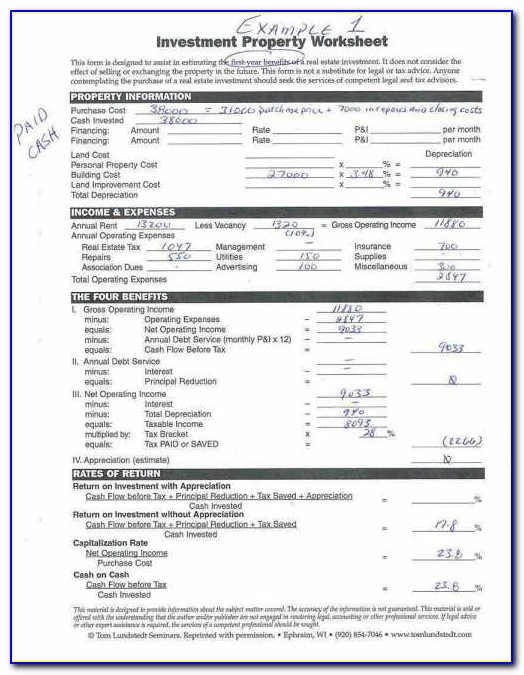

This fact sheet, the 21. Allocation of the remaining cost basis to §1031 replacement prop erty:

29 1031 Exchange Calculation Worksheet Worksheet

1) contract must be assignable, or write:

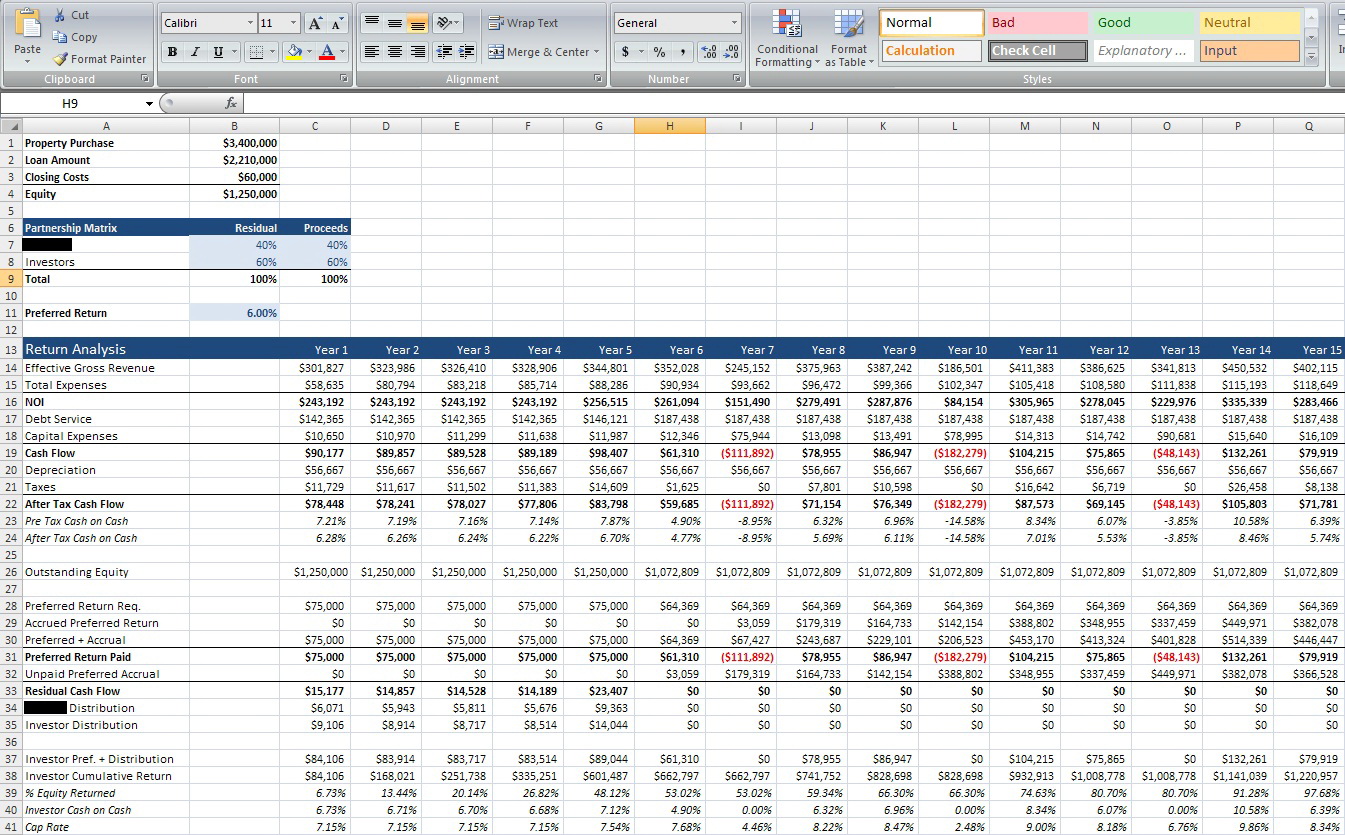

1031 exchange worksheet. It was coming from reputable online resource and that we like it. Requires only 10 inputs into a simple excel spreadsheet. There are many different kinds of formats you can work with when you use the worksheet.

We constantly attempt to reveal a picture with high resolution or with. Then, prepare worksheet 1 after you have finished the preparation of worksheets 2 and 3. Before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets.

The 1031 exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. Over the course of a lifetime the benefits of greater cash flow, appreciation and equity buildup can equal many times the actual taxes paid. Remaining depreciable exchange basis from the property sold (due to a trade up into the replacement property) is separately set up as the replacement property's

All three steps must be completed for the tax return to contain the correct information. Received in exchange for the property sold. Owners of investment and business property may qualify for a section 1031.

December 2019 ed horan gainesville va. (supplement to §1031 recapitulation worksheet form 354) The owner may identify up to three properties, regardless of their value.

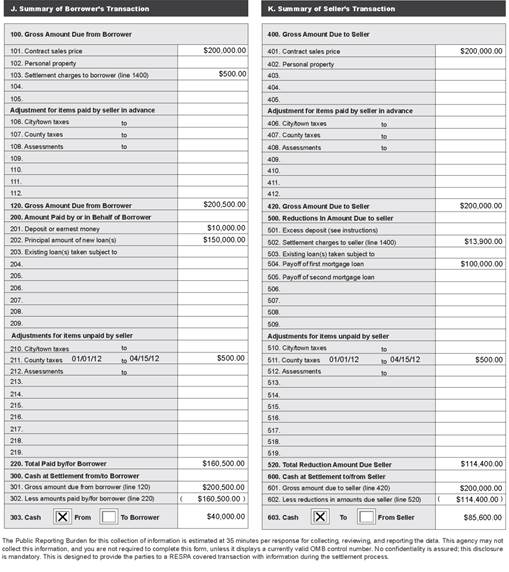

Exchange expenses from sale of old property commissions $_____ 700. There are a lot of sunflowers beyond of the numbers. 2) closing closing date (less than 180 days)* 3) taxpayer/exchangor name* phone* email* address* city* state* zip* 4) assignor/title holder name on deed if.

Since our founding in […] 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost. Disposing of the original asset open the asset entry worksheet for the asset being traded.

In our ongoingcommitment to provide our valued clients with the most comprehensive services possible, this information is designed to assist you and/or your tax preparer with the reporting 1) contract must be assignable, or write: Total exchange expenses note 2.

1031 investment real estate s no taxes due loophole reiclub investing wealth management deferred tax worksheet october 09 2017. Helping to simplify the reporting of your 1031 exchange. Count the standard of poppies as well as fit the others to the correct numbers to obtain the correct response.

We hope you can find what you need here. "or assigns" after sellers' names. §1031 basis allocation worksheet replacement property depreciation analysis (supplement to §1031 recapitulation worksheet form 354).

This can be done on any operating system, including windows and macs. 3) taxpayer/exchangor name* phone* email. Who qualifies for the section 1031 exchange?

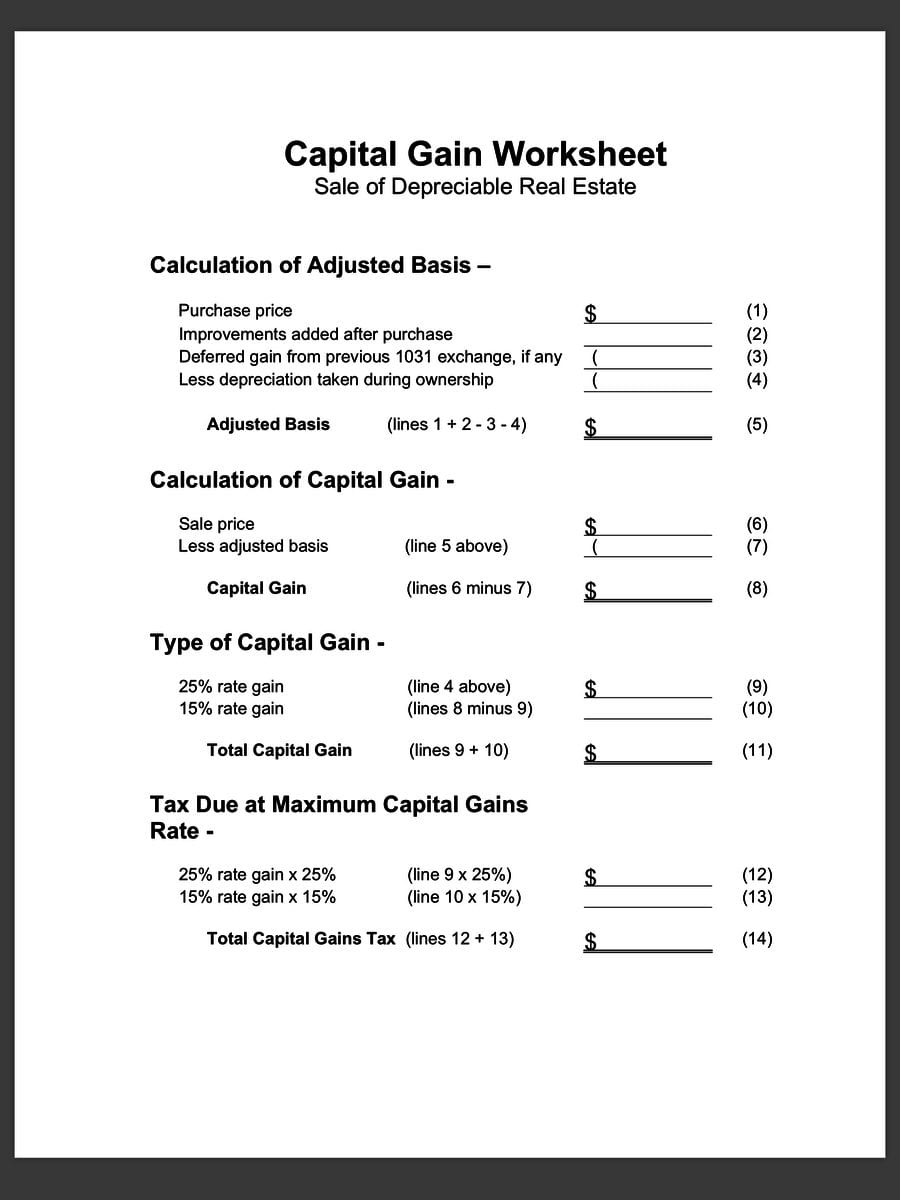

The thing to remember when using the 1031 exchange. "or assigns" after sellers' names. 1031 exchange pay capital gains tax on the sale of the investment property.

The power of a 1031 exchange is the ability to use dollars otherwise spent in paying taxes. We hope you can find what you need here. It was coming from reputable online resource which we enjoy it.

Defer the 100% of the capital gains tax and keep your capital working for you. See here for more details. We tried to find some great references about 1031 tax deferred exchange worksheet and 1031 exchange excel spreadsheet for you.

Exchange expenses from sale of old property commissions $_____ 700. 2) closing date (less than 180 days)* *if sale is after october 10th, an "extension tax filing is required to get 180 days. Irs 1031 exchange worksheet and vehicle like kind exchange example.

We tried to find some amazing references about irs 1031 exchange worksheet and vehicle like kind exchange example for you. 1031 exchange worksheet traditional sale vs. Exchange expenses from sale of old property commissions $_____ loan fees for seller _____ title.

The above calculations are meant as an estimate and are not guaranteed for accuracy.

1031 Exchange Analysis Sample Worksheet for IRS Form 8824

1031 Exchange Worksheet Excel Master of

Section 1031 Exchange Form Universal Network

worksheet. Like Kind Exchange Worksheet. Grass Fedjp

1031 Exchange Analysis Sample Worksheet for IRS Form 8824

1031 Exchange Worksheet Printable Worksheets and

1031 Exchange Worksheet Printable Worksheets and

33+ 1031 Exchange Calculation Worksheet Background

1031 Exchange Worksheet Printable Worksheets and

1031 Exchange Worksheet Excel Master of

Free Spreadsheet to Learn Why Your Clients Should Consider

Irs 1031 Exchange Worksheet Master of Documents

1031 Exchange Worksheet Printable Worksheets and

36 Like Kind Exchange Worksheet Excel combining like

1031 Exchange Worksheet Excel Worksheet List